A Blanket Mortgage Would Involve Which of the Following

A blanket mortgage is a great alternative that can be used to finance the purchase of multiple propertiesespecially for developers real estate investors and flippers. Blanket mortgage clause in the following language That for and in consideration from LAW MISC at San Beda College Manila - Mendiola Manila.

Rates may vary by state and are subject to change without notice.

. This option can provide you. A loan with a balloon payment at the end 4. Property Price Property Price.

The blanket mortgage might be structured with a balloon payment as well. Compared to a traditional mortgage the blanket mortgages include higher average costs. A blanket loan much like the mortgage you obtained when buying your first home requires collateral.

A blanket mortgage usually covers which of the following A More than one piece from ECON 101 at University of Hawaii. Risk-averse lenders might prefer mortgage terms no longer than 10 years. Two loans combined into one interest rate 3.

A blanket mortgage would involve which of the following. A blanket mortgage is often used to finance subdivision developments. BLANKET MORTGAGE SECURITY POLICY GENERAL CHANGE ENDORSEMENT To be attached to Master Policy Endorsement 11 This endorsement effective February 1 2019 forms a part of Master Policy No.

Plus it involves less work for more money on the part of the lender. A blanket loan or blanket mortgage is a type of loan used to fund the purchase of more than one piece of real property. Borrowers with a more significant down payment 75000 or more a higher credit score and a lower debt-to-income ratio are preferred by lenders.

Similar to a conventional mortgage the real estate acts as collateral under the loan and depending on the terms the individual pieces of real estate may. A blanket mortgage helps investors save time and money by only having one monthly mortgage payment. A blanket mortgage covers more than one parcel of land or lot.

The addition of new properties or deletion of sold ones happens without the need to refinance with a blanket mortgage another great advantage. AAM0003590 issued to Stateside APM by the Company. A fully amortized mortgage.

These commercial lenders like to see evidence that. Flippers and fixers. A blanket loan is one mortgage that covers multiple properties.

Borrowers who cannot keep up with their payments end up defaulting on their blanket mortgage and losing their properties altogether. A blanket mortgage usually includes a full release clause. A blanket mortgage is a single mortgage that covers multiple different properties.

Stricter conditions A blanket mortgage will be more challenging to qualify for than a standard house loan. A blanket mortgage allows house flippers to acquire multiple properties fix them up and sell them off at a profit without having to worry about the complication of having several mortgages. Many real estate developers and large investors often purchase more than one property at a time and a blanket mortgage allows them to do so with a much more simplified transaction of just taking out one loan as opposed to.

A blanket mortgage is a type of mortgage that finances more than one piece of real estate. A blanket mortgage and blanket loans are the same thing. Lenders put a lot of credence in the amount of time youve owned the subject properties within the blanket mortgage.

Please provide the information below so we can find more accurate rates. Conventional mortgage lenders following Fannie Mae or Freddie Mac loan programs dont typically allow blanket mortgages. They are best for anyone who is in a business that owns multiple properties such as house flippers and builders.

With a blanket mortgage the borrower will have more cash on hand by saving on costs associated with applying for and closing on multiple mortgages. Lenders will assess your financial profile and ultimately determine whether you can realistically pay back the loan. The group of assets serves as collateral for the loan.

When a blanket mortgage is placed upon a property and a release schedule is put into the mortgage showing the amount of the loan that must be paid off for each of the lots those individual amounts would likely be proportionately larger for the first lots that are sold. A blanket mortgage provides simplicity for investors who own multiple properties. Blanket loans are popular with builders and developers who buy large tracts of land then subdivide them to create many individual parcels to.

This limits their exposure to risk compared to longer-term blanket loans. A blanket mortgage is a single loan that attaches to multiple properties. A blanket mortgage allows real estate investors to acquire multiple properties to rent them out.

All of the following statements are true regarding a blanket mortgage except. Select a product to view important disclosures payments and assumptions. A blanket mortgage allows some of the lots of a subdivision to be released and no longer be.

The length of a blanket loan might range from 2 to 30 years. This allows the borrower to make lower payments for a period of time followed by paying a larger lump sum all at once. Blanket mortgages avoid multiple fees and can make managing and tracking payments easier but they may have a higher cost than a single.

Developers real estate investors and flippers commonly use Blanket mortgages. Better Mortgage Advisor Better Rates Lower Fees. A single loan with two or more parcels of property offered as security 2.

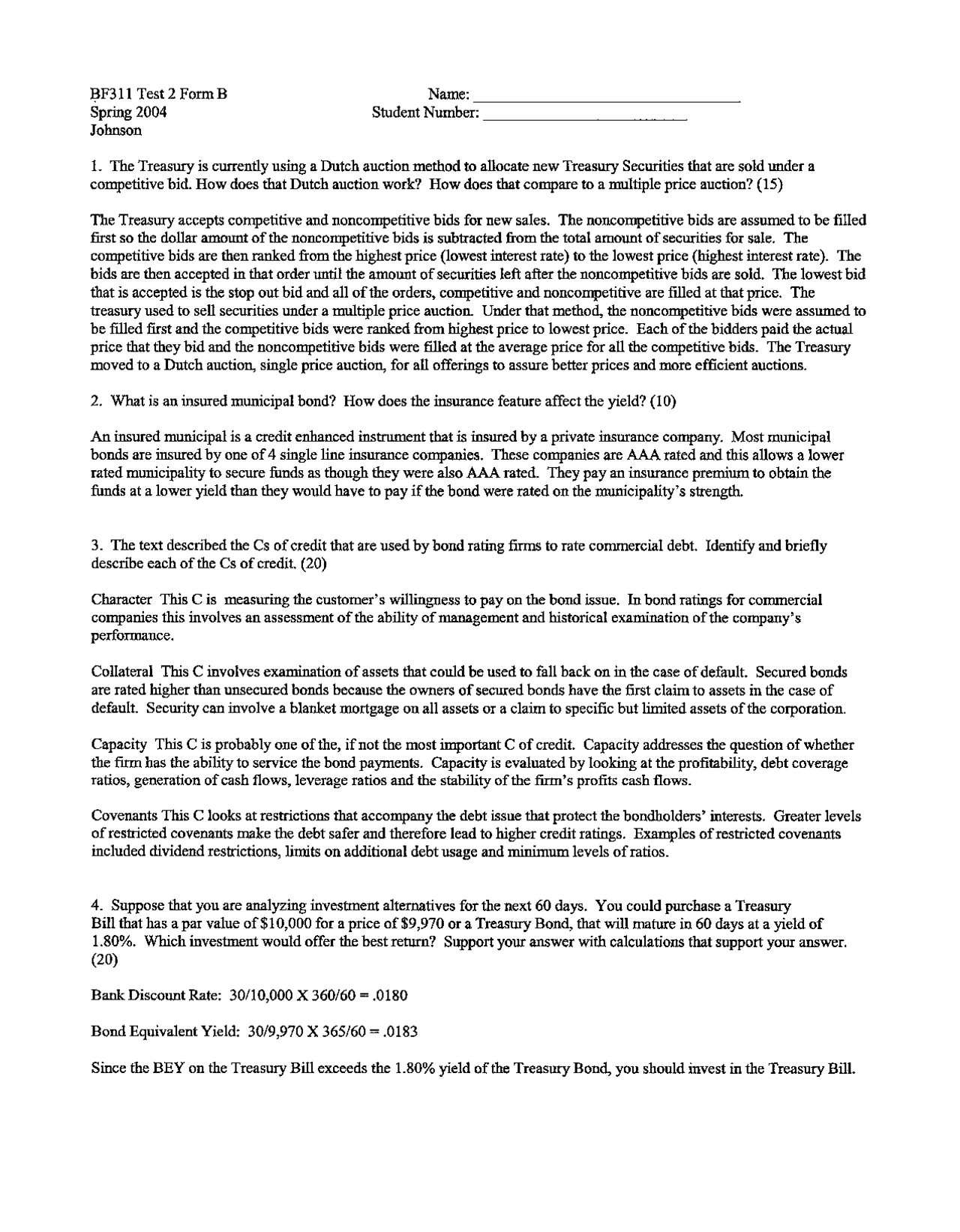

Test 2 Form B Solved Problems For Debt Securities Analysis Fin 311 Docsity

Comments

Post a Comment